CIA sangat pribadi/rahasia tentang operasi dan senjata, tetapi mereka membuka informasi tentang beberapa alat mata-mata kepada untuk publik saat ini yang dipajang di museum CIA yang dapat diakses publik. Seperti yang diharapkan, sebagian besar gadget/peralatan yang ditampilkan cukup mengesankan.

1. "Belly Buster" Hand-Crank Audio Drill

2. Letter Remover

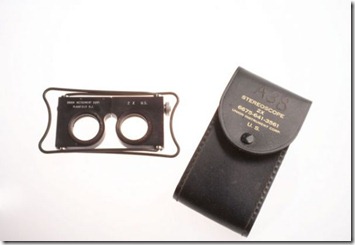

3. Stereoscope and Case

The stereoscope, digunakan selama Perang Dunia II, untuk membantu Sekutu menganalisis foto dan memeriksa gambar wilayah musuh yang diambil oleh pesawat dengan kamera terpasang. Hal ini memungkinkan mereka untuk melihat film ini dalam format 3-D.

4. Dragonfly Insectothopter

Dikembangkan oleh Kantor Penelitian dan Pengembangan CIA pada 1970-an, mikro Unmanned Aerial Vehicle (UAV) ini adalah kendaraan udara pertama berukuran serangga (Insectothopter) yang dikembangkan untuk mengeksplorasi pengumpulan data intelijen melalui perangkat miniatur.

5. CIA Semi-Submersible

Ini dirancang CIA pada tahun 1950. Kapal ini tidak membawa senjata, menyediakan tempat sempit, dan diperlukan sebuah "kapal induk" untuk transportasi dan pemulihan, tetapi bisa masuk ke daerah yang kapal normal tidak bisa masuki.

6. Microdot Camera

Untuk mentransfer dokumen rahasia selama Perang Dingin dibantu oleh kamera ini, microdot yang dapat mamphoto seluruh informasi dan membuat ke sepotong halaman kecil film. Microdots dapat tersembunyi di cincin, koin berongga dan item lainnya. Penerima akan membaca microdot dengan alat penampil khusus.

7. "Matchbox" Camera

The Eastman Kodak Company yang mengembangkan dan memproduksi kamera ini untuk Office of Strategic Services (OSS). Dibuat dalam bentuk kotak korek api yang digunakan pada saat itu, bisa jadi disamarkan dengan menambahkan label kotak korek api dalam berbagai bahasa dan gaya yang relevan dengan negara di mana ia akan digunakan.

8. Single-Use Encoder Pads

Bantalan satu kali pakai (OTP) yang diluncurkan untuk pencocokan dua set encoding: satu set adalah untuk encoder dan satu untuk decoder. Tidak ada dua halaman yang sama. Setiap lembar berisi kunci acak dalam bentuk kelompok lima-digit. Setelah sheet digunakan untuk mengkodekan pesan kemudian akan robek dari pad dan hancur. Karena kode yang digunakan hanya sekali, mereka hampir tidak terpecahkan.

9. “Dead” Drop Spike

Digunakan untuk memfasilitasi komunikasi yang aman antara agen dan handler nya, spike, yang berisi dokumen atau film, bisa didorong ke tanah oleh agen di sebuah tempat yang telah ditentukan dan kemudian diambil lagi.

10. M-209 Cipher Box

Perangkat cipher mekanis yang dirancang oleh Boris Hagelin yang banyak digunakan oleh Angkatan Darat AS selama Perang Dunia II. Kompak dan portabel, menggunakan serangkaian rotor untuk encode dan decode pesan militer rahasia.

11. Pigeon Camera

Kantor Penelitian dan Pengembangan CIA menciptakan kamera yang kecil dan cukup ringan untuk dipasang di burung merpati. Foto diambil dari burung yang terbang bisa dalam ratusan meter dari target, menghasilkan banyak gambar lebih rinci dibandingkan dengan metode menangkap gambar yang lain .

12. Surveillance Fashion

Untuk wanita yang menghadiri urusan affair, peralatan pengawasan tidak harus berpakaian lusuh dan kuno. pakaian dari Kantor Teknis Kesiapan ini membolehkan mata-mata untuk mengunyah makanan kecil dan menari waltz sementara diam-diam merekam ditengah dansa dan obrolan koktail.

13. Code in a Compact

Seorang agen wanita bisa diam-diam membedaki hidungnya sementara cermin ini bekerja.

14. Escape Map

Dicetak pada sutra, peta ini melarikan diri bisa dilipat efisien untuk disembunyikan dan tidak akan berisik saat dibuka dan ditutup. Peta ini dicetak dengan pewarna tahan air sehingga warna tidak akan pudar jika agen harus membuat pelarian diri di air secara mendadak.

15. A-12 Spurs

"taji," ini dipakai di pesawat terbang, diikat di atas tumit boot dan masing-masing melekat pada bola terhubung ke kabel di bawah kursi pesawat. Jika pilot harus keluar dalam keadaan darurat, kabel akan mengikat kaki pemakainya kembali di bawah kursi untuk memastikan keluar secara halus dan aman dari pesawat.